Reduce Transaction Time by 50% with Gingr Payment Processing

Juggling separate systems? Streamline your process and manage transactions easily with Gingr’s integrated payment processing. Your bottom line gets a boost, your payroll costs go down, and your staff gets their hard-earned tips and commissions.

Grow Your Revenue With Gingr Payments

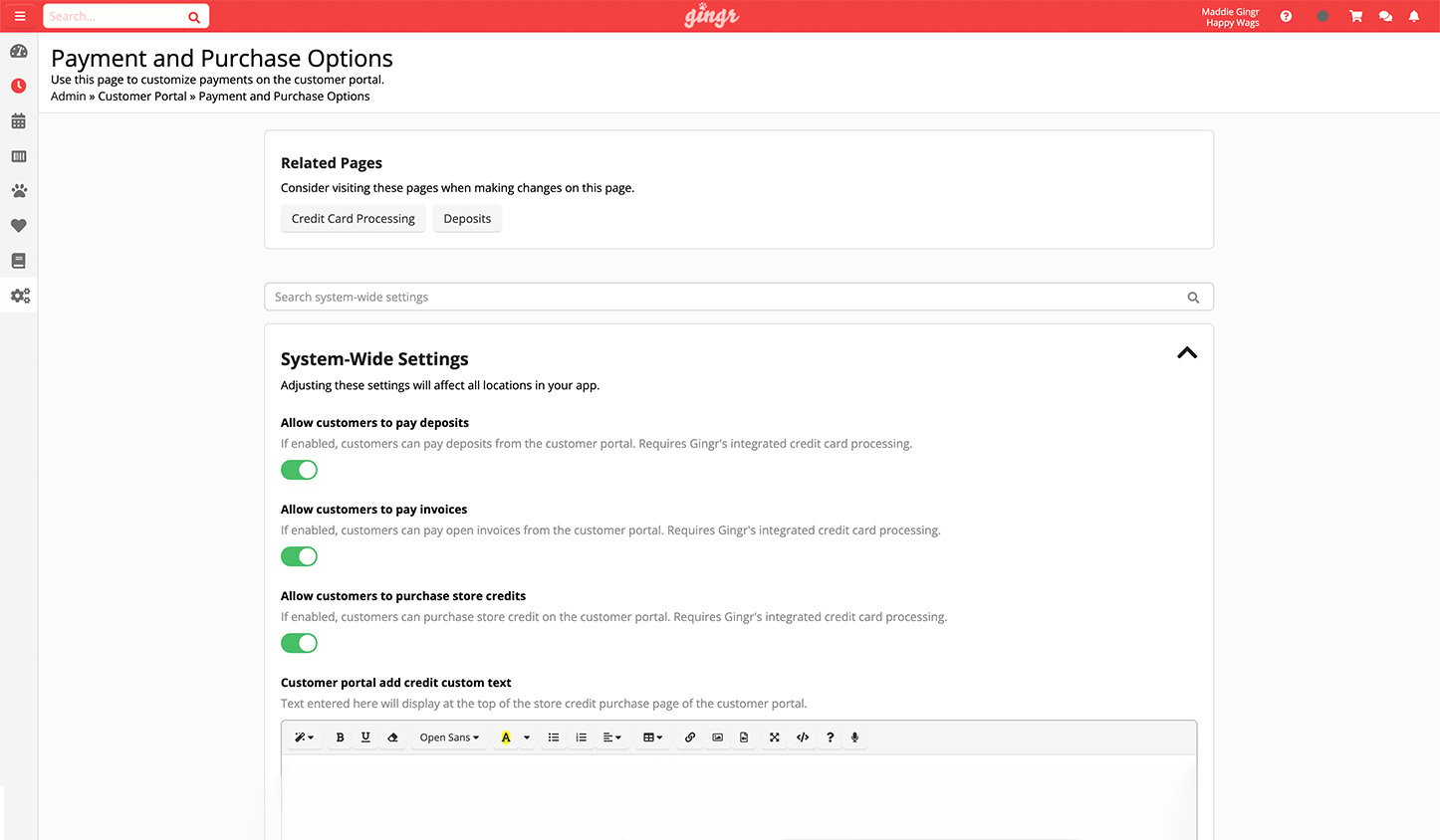

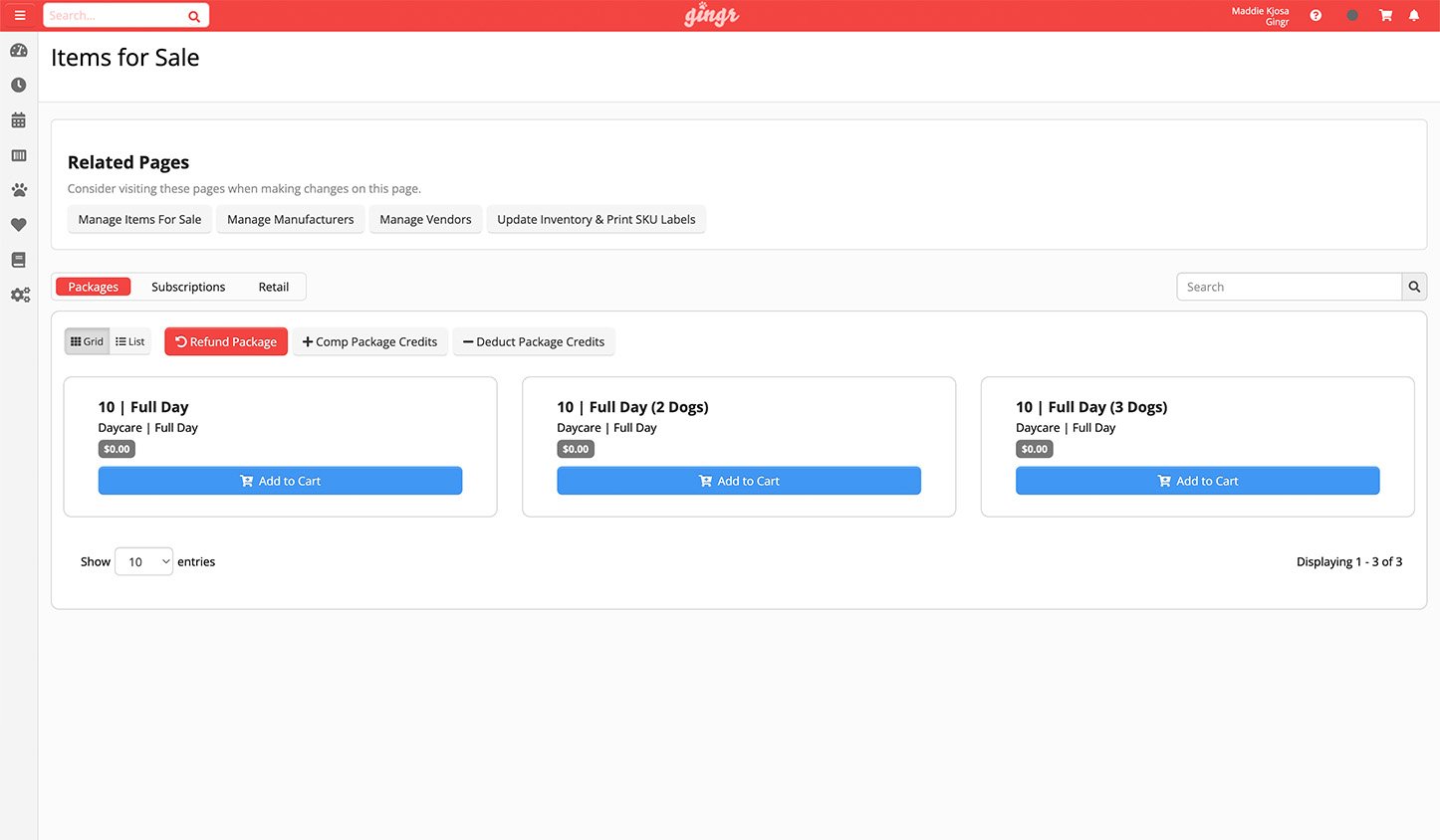

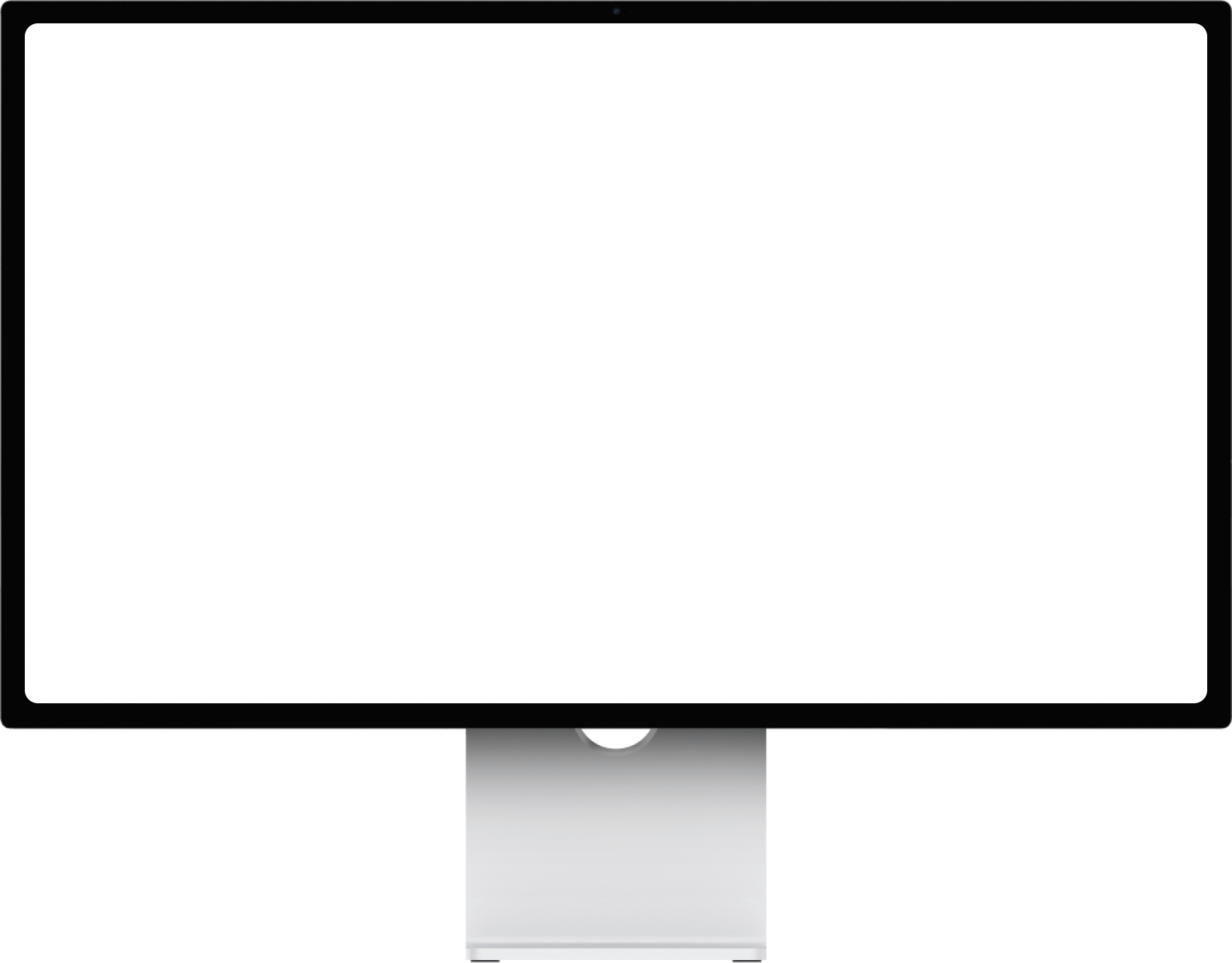

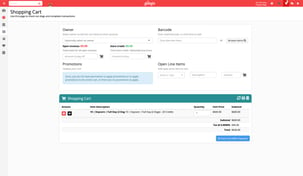

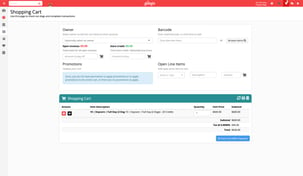

Transform how you handle transactions by reducing processing time and saving hours on reconciliations. Give pet parents a smooth experience with self-service deposits at booking and accurate invoicing that builds trust. Your team will unlock powerful tools like prepayments, add-ons, and recurring subscriptions—all accessible through Gingr’s centralized dashboard.

Developed and operated by Gingr, our pet business payment processing solution offers competitive pricing and unparalleled convenience. Your business can save time, reduce no-shows, and grow revenue effortlessly.

Key Benefits of Pet Business Payment Software

Online Payments

Meet customers where they are to build loyalty and repeat business.

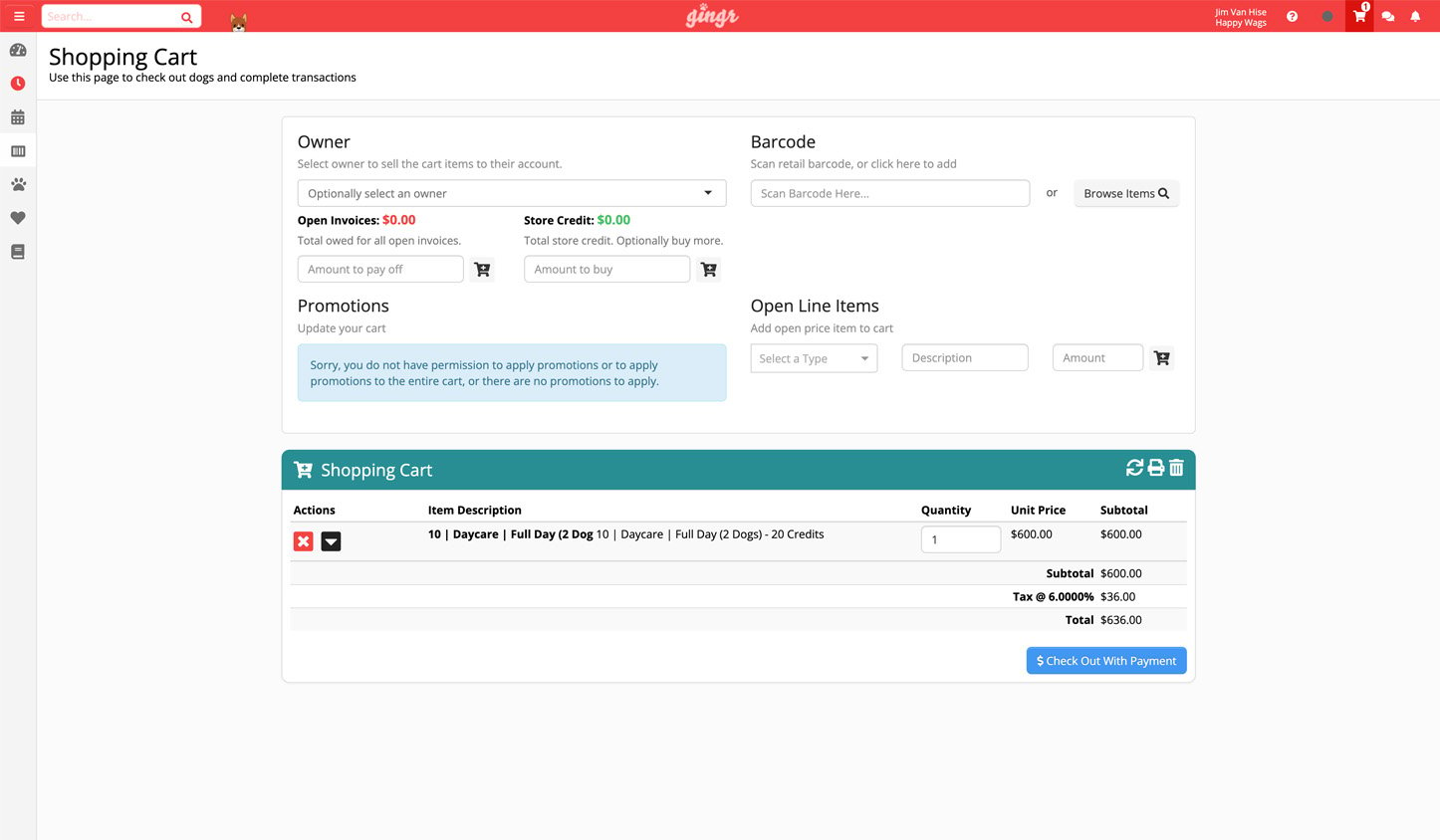

Faster Checkouts

Automated payments save you time and money.

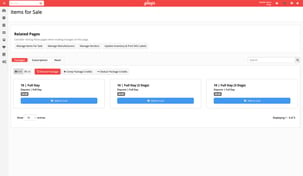

Packages

Keep pet parents and their companions coming back.

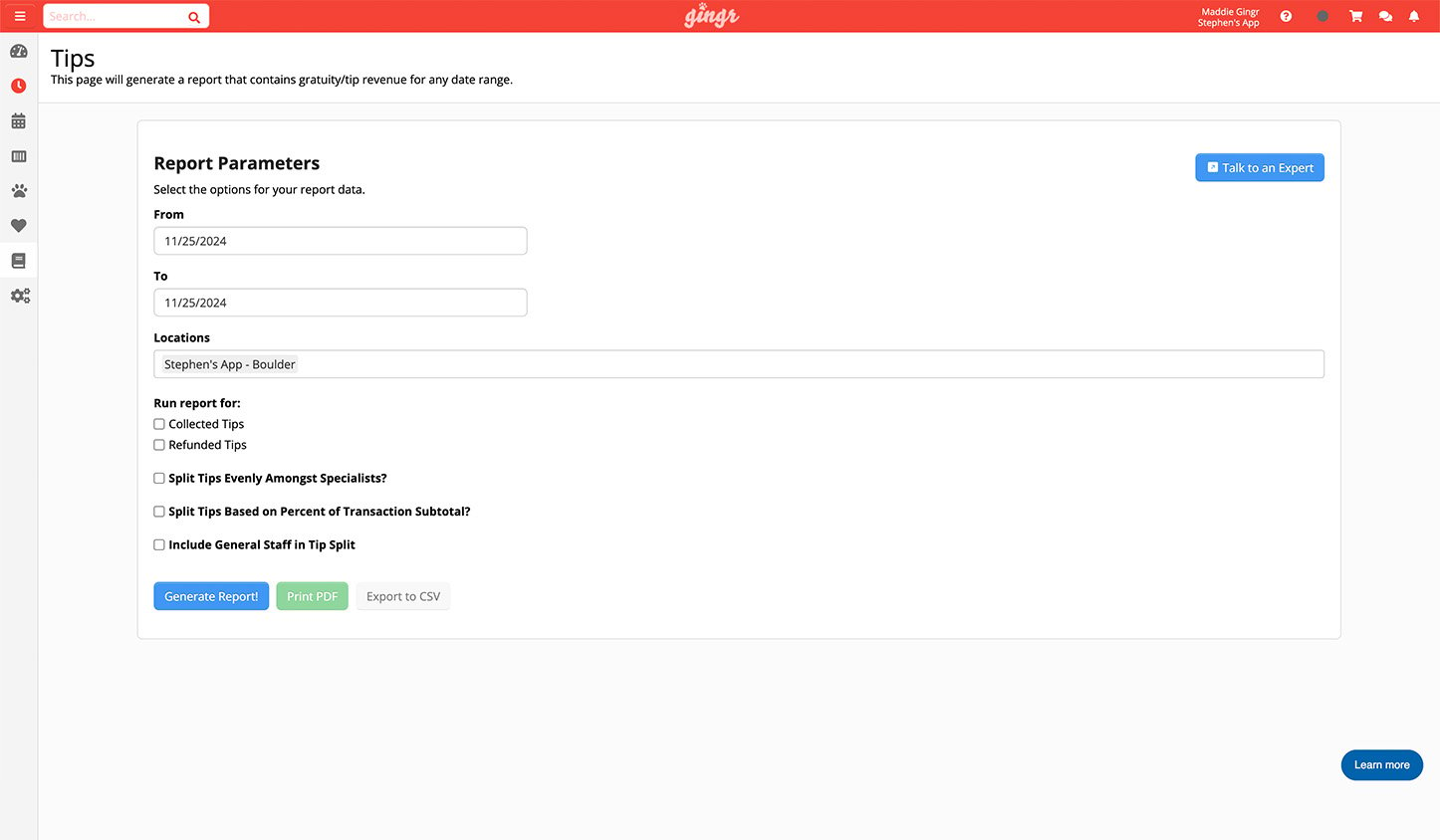

Tip Selection

Reward your staff for a job well done, the easy way.

Secure Payments

Peace of mind, every time.

Fast Reconciliation

Get paid the right amount for every reservation.

Save Time with These Additional Furtastic Features

With Gingr, you get everything you need to run a smooth and successful pet-care business. Our software helps you manage payments, scheduling, and customer communication, all while automating cumbersome tasks so you can spend more time caring for pets!

Winning with

Gingr Payments

Learn how DeWayne Cabel, founder of Anchor Up K9 Academy, leverages Gingr. “It’s a great platform to communicate with my clients, collect payments easily, select different training plans, and apply discounts,” DeWayne explains.

Gingr Payments FAQs

We recommend using an integrated payment processor that connects directly to your pet business management software. This will help you better track transactions, ensure payments are secure, and provide excellent customer experiences.

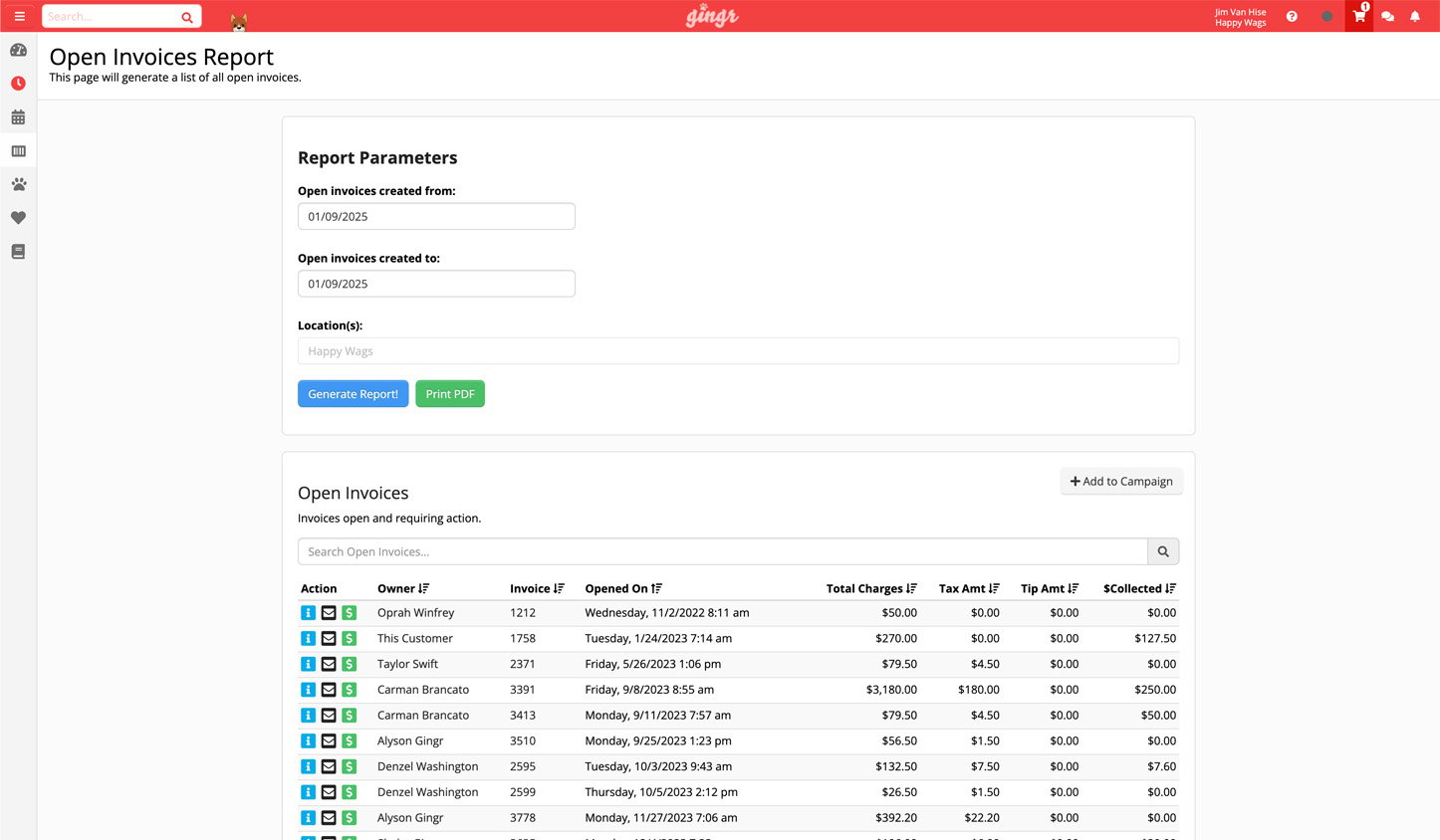

An integrated system will also simplify financial management workflows, automating your bookkeeping, eliminating manual entry errors, and allowing you to keep cards on file for added convenience. For a small business, the time you save on reconciliation or chasing unpaid invoices often outweighs the cost of processing fees.

One of the biggest advantages of using an integrated payment processing solution is that it streamlines payment collection for busy pet-care professionals and their clients.. Integrating payments with Gingr allows you to create invoices, accept payments, keep cards on file, and track transactions in one place. This saves you time and effort, reduces the risk of errors, and limits the potential for fraud.

Unsure if integrating payments with Gingr is right for you? Take this quiz to find out!

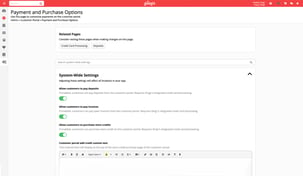

For businesses that collect payments in person, we provide several integrated credit card terminal options. These devices are pre-configured to communicate directly with your Gingr software. All of these options allow you to seamlessly collect tips from the device, helping you boost revenue while speeding up checkout.

Depending on your needs, you can rent or buy terminals at your convenience.

These actions are handled from Gingr, and you can issue the refund in just a few clicks without calling for support or wrangling a physical terminal. First, you’ll need to ensure the user issuing the refund holds the relevant permissions in the system. From there, you or the staff member can use Gingr’s flexible tools to handle the situation.

For instance, you can issue a line-item refund in which the customer will no longer owe you for the service. Or, if the charge was an error, you can void that payment. You can also issue store credit and denote the reason for the refund. This ensures your records remain accurate and detailed post-refund.

Yes, there are ways to accept payments away from your front desk. For instance, you can simply have customers pay via their device when booking their service or appointment. Or, choose one of the mobile-friendly payment processing devices that integrates with Gingr. Typically, these devices are handheld and have WiFi and/or LTE capabilities.

Having an integrated system inherently strengthens your defense against disputes. Gingr will link the payment directly to the signed digital service agreement and reservation details (including timestamps and IP addresses), giving you a comprehensive paper trail. In the event that a customer files a chargeback, you’ll have this evidence ready to prove the validity of the charge.